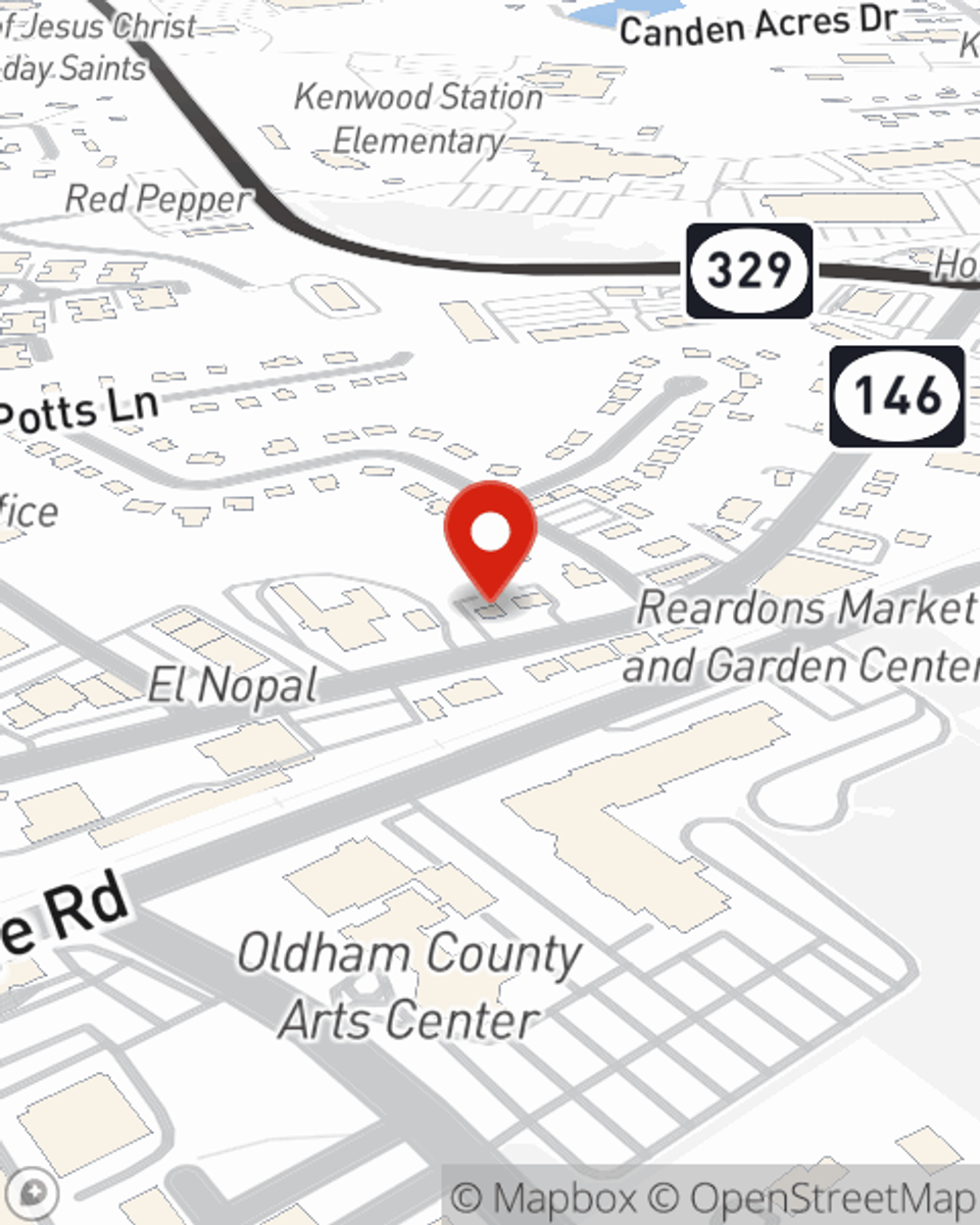

Business Insurance in and around Crestwood

Looking for small business insurance coverage?

Insure your business, intentionally

Cost Effective Insurance For Your Business.

You may be feeling like there is so much to do with running your small business and that you have to handle it all by yourself. State Farm agent Phil Beeson, a fellow business owner, is not unaware of the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

Looking for small business insurance coverage?

Insure your business, intentionally

Strictly Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your take-home pay, but also helps with regular payroll expenses. You can also include liability, which is key coverage protecting your financial assets in the event of a claim or judgment against you by a third party.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Visit State Farm agent Phil Beeson's team today to discover your options.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Phil Beeson

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.